Some Insight On Mobile Banking

Individuals who entrust their finances to banking institutions are likely familiar with the concept of ‘mobile banking.’

For those seeking a deeper understanding of this financial service, this article aims to provide valuable insights into its intricacies.

What Is Mobile Banking?

In straightforward terms, mobile banking refers to the practice of conducting financial transactions using a mobile device, such as a smartphone or tablet.

The process involves actions like receiving transactions from a bank on your phone, settling various bills, or sending money internationally.

One of the notable advantages of mobile banking is its flexibility, allowing financial transactions to take place virtually anywhere. However, it is crucial to acknowledge the security concerns associated with this method.

In our modern age, the widespread embrace of mobile banking across various banks and financial institutions underscores its growing convenience.

Many individuals prefer mobile banking due to its elimination of the need to physically deposit a check or visit an ATM.

Nevertheless, users must exercise caution while accessing mobile banking apps to prevent the compromise of personal information.

Security remains a paramount consideration in maximizing the benefits of this modern financial convenience.

Cybersecurity

Cybersecurity has become very important in the use of mobile banking operations in recent times. Cybersecurity consists of a wide range of measures used to keep all electronic information safe and private to avoid cases of theft and damage.

It also makes sure that data does not end up being misused. This extends from personal information to complex government systems as well.

Cyberattacks

In the realm of cybersecurity, three primary types of cyberattacks exist:

- Backdoor Attacks: Backdoor attacks occur when cybercriminals employ alternative methods to access a system, bypassing the usual authentication processes. While some systems may have intentionally designed backdoors, others unwittingly acquire them through errors or vulnerabilities.

- Denial-of-Service (DoS) Attack: Denial-of-service attacks are orchestrated to prevent the legitimate owner of a system from accessing it. In this type of attack, cybercriminals intentionally input incorrect passwords multiple times, leading to the system becoming locked or overwhelmed, thereby denying authorized users access.

- Direct-Access Attack: Direct-access attacks involve the use of bugs and viruses to infiltrate a system. The objective can vary, ranging from extracting sensitive information to modifying the system’s functionality. This type of attack leverages vulnerabilities in the system’s defenses to compromise its integrity.

Understanding these three categories of cyber threats is essential for individuals and organizations alike, as it facilitates the development of effective cybersecurity measures to safeguard against potential risks.

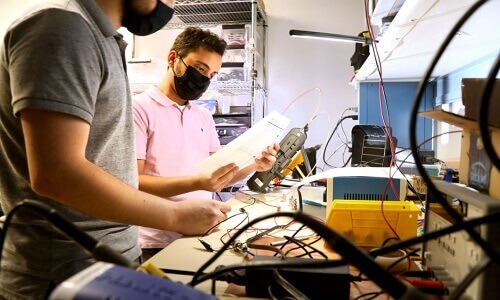

How To Secure Clients Against Cyber Attacks

Some of the steps that financial institutions can take to protect their clients against cyberattacks on mobile banking include;

- Educating their clients about cyber attacks and the use of strong and unique passwords

- Make sure not to access client data from a public location

Advantages Of Mobile Banking

Certainly, let’s refine and elaborate on the advantages of mobile banking in a professional yet accessible manner:

- Convenience: The advent of high-speed internet has significantly enhanced the convenience of financial transactions, allowing individuals to conduct their banking affairs from the comfort of their homes. Mobile banking leverages this connectivity, providing users with a streamlined and accessible platform for various transactions.

- Ease of Access: One of the prominent benefits of mobile banking is the elimination of the need to endure long queues at traditional bank branches. Users can effortlessly access their bank accounts at any time, even outside regular banking hours. The flexibility to manage accounts and perform transactions, including quick fund transfers, contributes to a more user-friendly and efficient banking experience.

- Reduced Errors: Mobile banking applications play a role in minimizing errors that users might encounter in manual transactions. The user-friendly interfaces and built-in safeguards help customers navigate financial processes more accurately, reducing the likelihood of mistakes compared to traditional methods.

Embracing mobile banking not only enhances the efficiency of financial transactions but also promotes a more seamless and error-resistant banking experience for users.

Disadvantages Of Mobile Banking

Mobile banking also has some disadvantages, although they are few. The errors are;

- Restricted Offerings: The current landscape of mobile banking exhibits limitations in its range of services. While there are numerous plans aimed at expanding functionality, the majority of offerings remain informative, focusing on features like checking bank balances and submitting credit card applications. Efforts are ongoing to diversify and enrich the array of services available.

- High Charges: A notable challenge in mobile banking lies in the disparity between the costs incurred by users and the perceived benefits. The charges associated with mobile banking transactions are currently deemed excessive, outweighing the advantages users gain from the convenience. Striking a balance between affordability and the value proposition of mobile banking remains an area requiring attention.

- Technical Issues: Mobile banking applications commonly grapple with technical problems, particularly in the realms of security and associated costs. Security concerns, such as the potential compromise of personal information, pose significant hurdles. Resolving these technical challenges is imperative to ensure the seamless and secure functioning of mobile banking applications.

Addressing these challenges is crucial for the continued evolution and widespread acceptance of mobile banking, ultimately enhancing its effectiveness and ensuring a more favorable cost-benefit ratio for users.

Conclusion

Mobile banking offers individuals the convenience of accessing their bank accounts from virtually anywhere, provided they have a technological device and an internet connection.

When opting for mobile banking, it is crucial to familiarize yourself with all relevant information, particularly insights shared by qualified professionals in the field. This ensures a comprehensive understanding of the subject matter.