Investing in tech companies can be lucrative, but it’s essential to approach it with caution and understanding.

The success of companies like Facebook (now Meta), Tencent, Snapchat, Instagram, and WhatsApp is evident, with billions in worth and substantial annual revenue.

However, investing in tech stocks requires careful consideration, as stock prices can be volatile.

Before diving into such investments, it’s crucial to be well-informed. This article aims to educate you on key factors to consider before investing in the stock of a tech company.

While tech companies can experience significant growth, it’s important to acknowledge that they also go through periods of ups and downs.

For instance, even giants like Facebook faced challenges in 2018, attributed to issues related to handling user data and the spread of fake news on the platform.

Understanding the potential risks and challenges a tech company may face is vital for making informed investment decisions.

Stay tuned for insights that will help you navigate the dynamic landscape of tech investments.

How To Analyze A Tech Company Before Purchasing Its Stocks

Conducting thorough analysis is a crucial step before investing in any tech company’s stocks. Both fundamental and technical analyses are vital components in making informed investment decisions.

It’s not enough to base your investment solely on a company’s past success or recent financial gains.

Fundamental analysis involves assessing the company’s financial health, including factors such as revenue, earnings, debt, and overall market position.

Understanding the company’s business model, competitive landscape, and potential for future growth is key to evaluating its long-term viability.

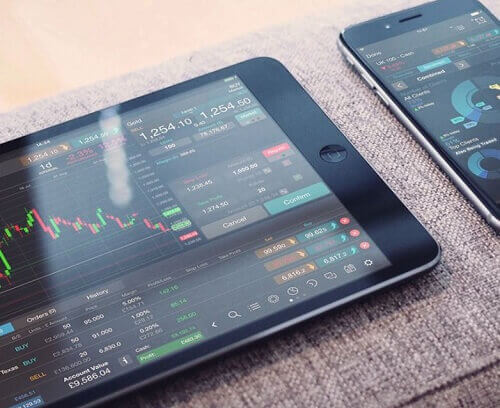

On the other hand, technical analysis involves studying price patterns, trading volumes, and other market indicators to make short-term predictions about stock movements.

By combining these analyses, you can gain a comprehensive view of the tech company’s potential performance in the stock market.

Remember, investing involves risks, and a well-informed approach is essential to minimize those risks and make sound investment decisions.

Fundamental Analysis

Assessing a tech company’s stock requires considering the current economic and industry conditions.

Take a close look at the company’s financials and management. Researching the company’s finances is crucial for making informed investment decisions.

Technical Analysis

In technical analysis, you’ll utilize statistics, incorporating past stock prices and volume. Unlike focusing on intrinsic value, technical analysis enables the identification of patterns and trends in the current and future price movements of the stock.

As part of your due diligence, delve into the tech company’s growth analysis. This encompasses mobile growth, usage trends, risks, and outlook.

Understanding these factors aids in forming a comprehensive view of the company’s potential trajectory in the market.

When You Have Decided To Buy

Once you’ve determined that the stock of a particular company is a good buy at its current value, the next step is to calculate the number of shares you want to purchase.

Many online brokers offer calculators that help you determine the quantity of shares you can afford. This tool also provides insights into the market capitalization of the company you’re considering for investment.

Conclusion

Before diving into an investment in a tech company, it’s crucial to conduct thorough due diligence and ensure you’re making informed decisions.

Don’t simply buy stocks based on a company’s recent good performance. Analyze factors such as the overall state of the tech industry and the financial health of the specific company you’re considering.

This careful evaluation is key to securing potential profits and avoiding unexpected losses.