Forex trading, short for foreign exchange trading, has become a popular avenue for individuals seeking to generate income.

Similar to stock and commodities trading, forex trading is a form of investment that involves the exchange of one currency for another in the global financial market.

In essence, forex traders aim to capitalize on fluctuations in currency exchange rates, predicting whether a particular currency will strengthen or weaken against another.

The goal is to buy or sell currencies at opportune moments to profit from these price movements.

If you are unfamiliar with forex trading or have been seeking more information about it, this article will provide you with a brief overview, shedding light on the fundamental principles and dynamics of this form of investment.

What Is Forex Trading?

Forex exchange, commonly known as forex trading, involves the buying and selling of world currencies. While the term “forex exchange” is frequently used, it is also referred to as forex trading when conducted online through computers and smartphones.

The forex trading market operates over the interbank market, where global currencies are traded continuously, 24 hours a day for five days a week.

Notably, forex trading stands as one of the largest financial markets globally, boasting an estimated daily trade volume exceeding $5 trillion.

This significant market connects broker firms and banks through an online network, facilitating the exchange of currencies on a global scale.

History

The origins of forex trading trace back to a barter system that existed hundreds of years ago, where people exchanged goods directly.

Recognizing the limitations of this barter system, an organized channel of trade was eventually established.

Metal coins were introduced to address the challenges of bartering, providing a standardized medium of exchange.

Before World War I, many banks allowed the conversion of currencies into gold, but this led to political instability, particularly concerning inflation.

Consequently, forex controls were implemented to safeguard local and national interests.

In 1944, the United States introduced the Bretton Woods Agreement, establishing a system of fixed exchange rates that tied currencies to gold and stabilized the US dollar and other currencies.

This agreement played a pivotal role in shaping the forex market, setting the stage for its development into one of the largest financial markets globally.

Over the years, forex trading has evolved, shedding restrictions on capital flow in many countries and becoming an independent market where currency rates are determined based on perceived values.

Its popularity is attributed to features such as round-the-clock trading, low-cost trading, and the availability of leverage, making it a significant player in the global financial landscape.

Currency Pairs

Currency pairs in forex trading refer to the two currencies involved in a trade when a trader buys or sells a particular currency.

Each currency pair consists of a base currency and a quote currency, and the value of one currency is expressed in terms of the other.

Some of the most commonly traded currencies in the forex market include the Japanese Yen (JPY), the U.S. Dollar (USD), the Swiss Franc (CHF), the Canadian Dollar (CAD), and the Australian Dollar (AUD).

These currencies are often part of major currency pairs and are actively traded due to their significance in the global economy.

Traders analyze and speculate on the relative value of these currency pairs to make informed trading decisions.

Broker

In the context of forex trading, a broker is a financial firm or platform, often represented as a forex app in contemporary terms, that facilitates and enables individuals to engage in currency trading.

These brokers provide the necessary infrastructure, including online platforms, for traders to buy and sell currency pairs.

When using a forex app or platform provided by a broker, individuals can execute trades, analyze market data, and manage their portfolios.

Brokers typically charge fees for their services, and one of the most common fees is known as the spread.

The spread is the difference between the buying (ask) and selling (bid) prices of a currency pair and represents the broker’s compensation for facilitating the trade.

It’s important for traders to be aware of and understand the fees associated with their chosen broker, as they can impact overall trading costs and profitability.

Base And Variable Currency

In forex trading, individuals engage in the exchange of currency pairs. When trading forex, a person essentially sells one currency and buys another simultaneously.

This transaction involves the simultaneous purchase (or going long) of one currency and the sale (or going short) of another.

Currency pairs are defined by a base currency and a quote currency. The base currency is the one being traded, while the quote currency indicates the value of the base currency.

The exchange rate illustrates how much of the quote currency is required to buy one unit of the base currency.

For example, in the currency pair EUR/USD, if a trader goes long (buys), they are buying euros and simultaneously selling an equivalent amount of U.S. dollars.

If they go short (sells), the transaction involves selling euros and buying U.S. dollars. This constant buying and selling of currency pairs form the basis of forex trading.

Traders aim to profit from the fluctuations in exchange rates between the two currencies in a pair.

Who Can Trade?

The accessibility of forex trading has increased significantly, allowing almost anyone with a computer or smartphone and an internet connection to participate.

However, it’s crucial to emphasize the importance of knowledge and understanding in forex trading.

While the barrier to entry is low, the risks involved in forex trading can be substantial. It’s advisable for individuals to acquire a solid understanding of market dynamics, trading strategies, risk management, and other relevant factors before engaging in forex trading.

Without the necessary knowledge and skills, there is a considerable risk of financial losses.

Success in the forex market hinges on education, practice, and perpetual learning. Aspiring traders must dedicate time to grasp a thorough comprehension of the market and its intricacies, empowering them to make informed decisions and manage potential risks effectively.

Where To Trade

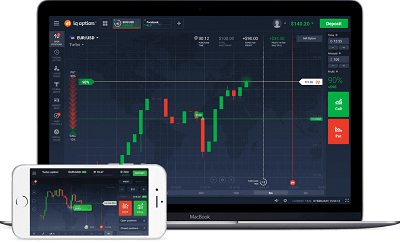

Absolutely, technological advancements have greatly simplified the process of engaging in forex trading. With just a smartphone or computer and a reliable internet connection, individuals can access the forex market from virtually anywhere in the world.

To get started, traders typically download a forex app provided by their chosen broker. This app serves as the platform through which trading activities take place.

These apps offer user-friendly interfaces, real-time market data, and various tools to analyze and execute trades.

The convenience of trading on a mobile device or computer enhances accessibility and flexibility for traders.

However, while the ease of access is notable, it’s essential for traders to choose a reputable broker and gain a good understanding of the market and trading principles to navigate the complexities of forex trading successfully.

Conclusion

Prior to entering the realm of forex trading, it is prudent to undergo educational classes to adequately prepare oneself for this financial endeavor.

Acquiring a comprehensive understanding of market dynamics, trading strategies, and risk management is paramount for success.

Furthermore, a judicious choice of a broker is imperative. Opting for a reputable broker with transparent and moderate charges ensures a secure trading environment and enhances the overall trading experience.

Forex trading stands as a prominent online investment avenue. This insight aims to underscore the importance of informed decision-making and highlights key considerations for those contemplating participation in the forex market.