5 Easy Ways To Withdraw From MTN Mobile Money Without ID Card

Seeking guidance on withdrawing MTN mobile money without presenting an ID card? MTN Ghana has recently implemented a requirement for mobile money customers to furnish an identification card at mobile money agent locations for cash withdrawals.

Originally slated for implementation in February, MTN deferred the rollout to April 2nd to ensure comprehensive public awareness and engagement. As of now, the policy is fully operational.

The implementation of this new policy has understandably caused unease among many individuals, particularly those who may have misplaced their ID cards used for mobile money registration.

Consequently, some MTN customers have opted to transition to mobile money services provided by alternative telecom companies within the country.

This shift has inevitably impacted the regular withdrawal practices associated with the MTN mobile money platform.

In response to the requirement for identification during cash withdrawals, it’s imperative to note that six types of valid ID cards are accepted for such transactions: a voter’s ID card, Passport, National identification card, Driver’s License, SSNIT ID, and NHIS ID.

While some individuals may still possess their ID cards, the pressing concern arises when faced with situations requiring urgent access to funds without immediate access to one’s ID card.

Nevertheless, for those committed to remaining loyal to MTN, there has been a concerted effort to navigate the directive in instances where ID cards are unavailable.

To address this challenge, we’ve compiled a list of alternative methods for withdrawing MTN mobile money without the necessity of presenting a valid ID card.

It’s important to understand that MTN Ghana has implemented this directive in response to the proliferation of fraudulent activities observed within their mobile money network, prioritizing security measures to safeguard both customers and the integrity of their services.

Adhering to the directive is paramount to safeguarding your funds and mitigating the risk of falling victim to mobile money fraud.

In the unfortunate event of encountering such fraudulent activities, it is essential to know how to effectively report MTN mobile money fraud cases in Ghana.

We have prepared a comprehensive guide outlining six straightforward methods for reporting such incidents.

This article specifically caters to individuals who may find themselves without an ID card, as MTN has been known to enforce strict adherence to this requirement, even in circumstances where legitimate claims are involved.

Let’s delve into the various alternatives available for withdrawing funds from your MTN MoMo account in situations where presenting an ID card is not feasible.

Withdraw From ATM Machine

One convenient method for withdrawing funds from your mobile money account without an ID card is through cardless transactions at compatible ATMs.

While initially limited to select ATMs, the availability of this feature has significantly expanded in recent years, offering more accessibility and convenience to users.

To initiate a cardless withdrawal, you’ll need to generate a token from your mobile money account, which serves as the authorization for the transaction.

It’s worth noting that most ATMs may only dispense cash in GHS 10 denominations or higher, necessitating withdrawal planning accordingly.

This method provides a rapid and hassle-free means of accessing your mobile money funds at any time of the day, offering flexibility and convenience to users.

How To Withdraw MTN Mobile Money From ATM If You Don’t Have ID Card

Visit the nearest bank that has an ATM Machine that supports Cashless withdrawal.

Read on as I share with you how to withdraw the MTN mobile money token

- Dial *170# on your mobile phone.

- Select Financial Service.

- Choose Bank Service.

- Opt for ATM CashOut (Option 3).

- Press 1 to generate a Token.

- Input your Four Digit Secret Code.

- Specify the Amount you wish to withdraw.

- Confirm the transaction with your Mobile Money PIN.

- Wait for the message containing your Mobile Money token.

- At the ATM, select Cardless Withdrawal.

- Pick MTN Mobile Money from the options.

- Enter the provided Token Code.

- Input your MoMo PIN.

- Indicate the Amount to receive your money.

Send To A Friend With An ID Card

Another viable option for accessing your mobile money funds without presenting an ID card is to transfer the money to a trusted friend who possesses a valid ID card. Your friend can then visit a mobile money vendor on your behalf to withdraw the funds.

Additionally, if your friend happens to have the necessary amount on hand but no immediate need for it, they can provide you with the cash immediately upon receiving the transferred amount.

Subsequently, when the need arises, they can proceed to withdraw the funds from their account.

While this method offers convenience, it’s important to consider that transaction charges may apply. You will likely incur fees for sending the money, and your friend may also face charges when withdrawing the funds for you.

It’s advisable to discuss and agree upon how these charges will be handled to avoid any misunderstandings.

Despite this consideration, leveraging the assistance of a trusted friend remains a recommended and practical solution for accessing mobile money funds without an ID card.

Sending To The Merchant

While another option for accessing your mobile money funds without an ID card is to send the money directly to a trusted merchant, this method is generally discouraged due to potential safety concerns.

The safety of this method is uncertain, as not all mobile money agents can be considered trustworthy.

It’s crucial to recognize that some mobile money agents may be involved in fraudulent activities themselves, and in some cases, they may collude with fraudsters to exploit unsuspecting individuals. Therefore, exercising caution is paramount when considering this method.

If you have a pre-existing relationship with a mobile money agent whom you trust implicitly, you may opt to make payments to them via their phone and receive the corresponding cash.

However, it’s essential to be mindful of potential deductions for transaction charges when sending money to the agent’s phone.

It’s important to reiterate the importance of exercising discretion and only engaging in such transactions with mobile money agents whom you know personally and trust implicitly.

Remaining vigilant and cautious can help mitigate the risk of falling victim to fraudulent schemes perpetrated by unscrupulous agents.

Using 3rd Party Apps

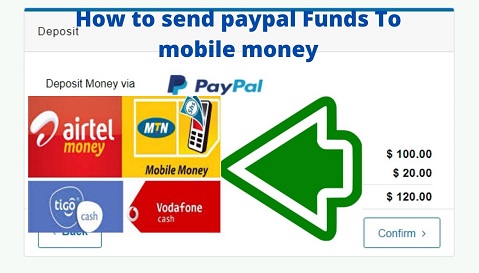

Another alternative for accessing your mobile money funds without presenting an ID card is to utilize third-party applications that facilitate transfers to your bank account or other desired locations.

These applications, such as Palmpay, Slydepay, Expresspay, and numerous others, offer a convenient means of transferring funds securely.

Once the funds are transferred to your bank account via these apps, you can easily access them by using the ATM services provided by your bank.

This method provides flexibility and accessibility, allowing you to withdraw your funds conveniently from any compatible ATM.

Utilizing third-party apps for fund transfers offers versatility and convenience, enabling you to manage your finances effectively without the need for an ID card.

Send To Other Mobile Money Networks

If you find the new directive from MTN Ghana to be restrictive, a practical solution is to transfer your funds from your MTN MoMo wallet to alternative mobile money networks such as Vodafone Cash or AirtelTigo Cash.

By doing so, you can circumvent the need for presenting an ID card during transactions.

Should you encounter difficulties in executing this transfer, another viable option is to transition to the mobile money platform of a different network service provider.

Presently, MTN is the sole network implementing the ID card requirement as a measure to combat fraud.

Switching to an alternative network’s mobile money platform can effectively alleviate the constraints imposed by this directive, offering you greater flexibility and convenience in managing your funds.

Conclusion

These are the methods you can utilize to access your funds without presenting an ID card. It’s important to adhere to the directive if you possess a valid ID card, as compliance aids MTN in combatting mobile money fraud and fortifies the security of the Mobile Money platform.

Speaking of MTN, did you know that you can make free calls on the MTN network? Be sure to check out our article detailing how to make free calls on MTN.

Additionally, if you have bonus credit on your MTN phone that is about to expire, learn how to extend it by reading our comprehensive guide.

If you’ve been attempting to secure an MTN Quickloan without success, discover why you may not qualify for the loan by delving into our article on the subject.

Furthermore, if you’re unsure what to input in the reference tab when sending mobile money, our article explains the significance of the reference and provides guidance on what to input.

Additionally, learn how to update your MTN SIM card details and locate AirtelTigo offices for your convenience. Stay informed and make the most of your mobile network services with our insightful articles.

One Comment